Opportunity Zones in Palestine, Texas, Make it Competitive for Development

29 Dec 2025

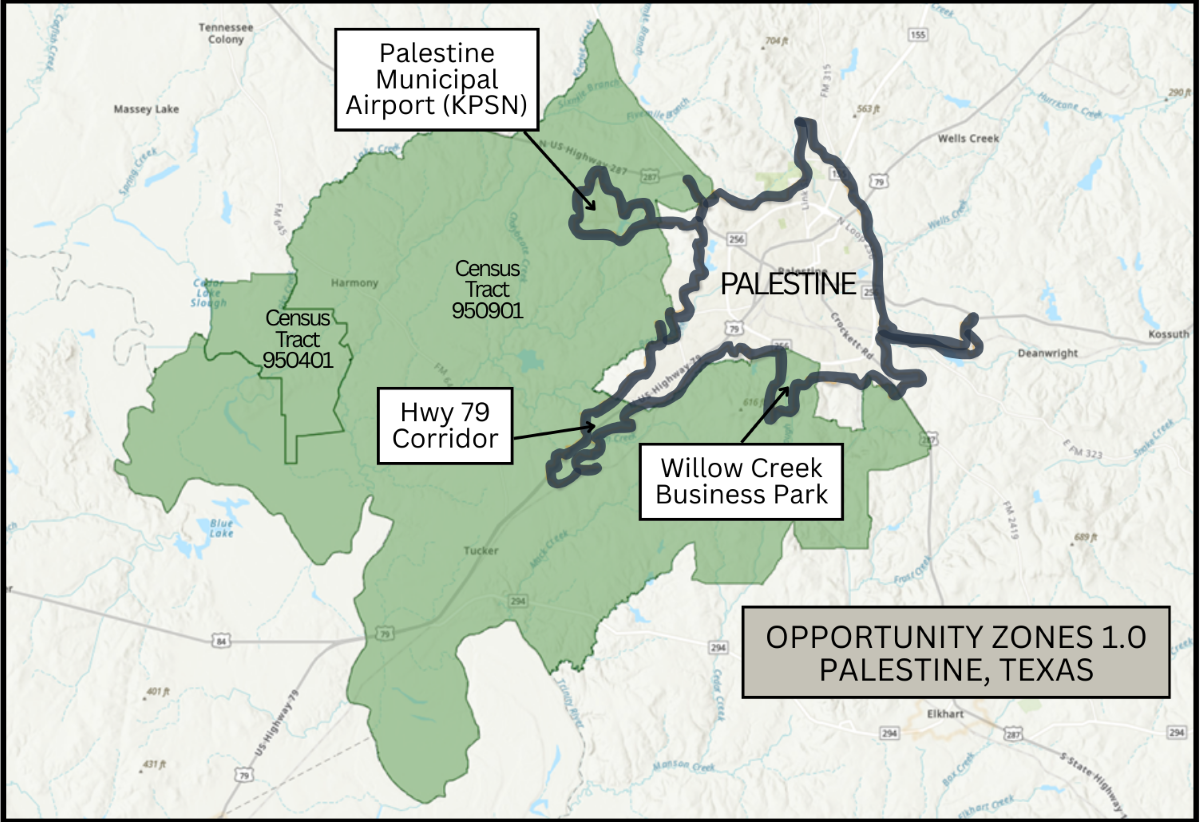

Palestine, Texas, is strategically positioned for growth as home to two federal Opportunity Zones. In March 2018, the State of Texas nominated 628 census tracts across 145 counties for Opportunity Zone designation, formally launching the program’s use across the state under the original Opportunity Zone 1.0 framework.

Within the city limits, Opportunity Zone areas are primarily located at the Willow Creek Business Park and the Palestine Municipal Airport, with additional portions along Highway 79 on the city’s Southwest side. Although much of the designated area lies outside the city limits, these in-city zones provide a strategic advantage in attracting new businesses and development.

“Site selectors need to know that opportunity zones are a tool, not a substitute for a strong business case,” says Dr. Cecilia Cuellar Tapia, Junior Research Analyst at The Hibbs Institute for Business and Economic Research at the University of Texas at Tyler. “An opportunity zone can make a project financially viable, especially when compared against a parcel that doesn’t fall within one of these designated areas.”

Opportunity Zones were created in 2017 under the Tax Cuts and Jobs Act, and there are currently 8,700 zones across the United States. Read more about this designation and how it promotes economic development.

What Is Opportunity Zone 1.0

The original Opportunity Zone program was designed to encourage long-term private investment in designated areas by allowing investors to defer and reduce capital gains taxes through Qualified Opportunity Funds. Under this framework, investors could defer capital gains until sale or a defined holding period. Investments held for at least five years qualified for a 10% step-up in basis, on the deferred gain. Investments held for at least seven years qualified for a 15% step-up. Investments held for at least ten years allowed investors to permanently exclude taxes on any additional appreciation of the investment.

Developers and investment groups often view Opportunity Zone designation as a financial “tiebreaker” rather than a primary project driver, helping move otherwise marginal projects into financial viability.

Understanding the Tax Benefits of Opportunity Zones

Opportunity Zones provide tax benefits to the companies and investment groups that utilize them. Companies will temporarily defer taxes on their capital gains by placing their assets into an opportunity fund. The taxes are deferred until the company sells the asset or until 10 years have passed. If an investment is held for at least 10 years, the taxes are forgiven.

“The Opportunity Zone is an incentive that becomes valuable when an investor group is planning a long-term hold,” says Dr. Cuellar Tapia. “It is often used for borderline deals where conventional financing alone could not support the project.”

Dr. Cuellar Tapia adds that an Opportunity Zone does not replace the fundamental characteristics of a specific community or location. Site selectors still prioritize location, land, cost, workforce, utilities, and other factors before they consider an Opportunity Zone. However, the zone designation could be a final factor that tilts the scales in a project’s favor.

Opportunity Zones Align Incentives with Community Needs

Opportunity Zones benefit not only investors and businesses expanding into new areas, but also the communities that receive investment through these projects.

“The purpose isn’t just tax relief, it is bringing capital into places with economic risk,” says Dr. Cuellar Tapia. “The equity from these zones can bring grocery stores to food deserts, fund workforce housing, and add health clinics to communities.”

By investing in essential services and housing, communities can improve their quality of life, supporting workforce retention and attraction efforts. This can create a snowball effect, where business investment through the opportunity zone allows a community to improve, and these improvements then attract other companies that see potential in the region.

“It’s important to bring new projects to the community while also addressing the needs of residents,” says Dr. Cuellar Tapia.

In the long run, Opportunity Zones can actually expand the tax base. They can increase employment and support the creation of higher-wage jobs, while attracting new residents and businesses.

What’s Changing Under Opportunity Zone 2.0

Legislation passed in 2025 permanently extended and modernized the Opportunity Zone program, commonly referred to as “Opportunity Zone 2.0.” Beginning January 1, 2027, new Opportunity Zone designations will be issued every ten years, and states — including Texas — will be able to nominate up to 25% of eligible low-income census tracts in each cycle.

The updated program removes the former “contiguous tract” rule and introduces stricter income and poverty eligibility thresholds to better focus investment in economically distressed areas.

For investments made after December 31, 2026, the tax deferral structure shifts to a rolling timeline based on the year of investment rather than a fixed sunset date. Standard Opportunity Zone investments will continue to receive a 10% basis step-up after a five-year hold, while rural-designated zones may qualify for enhanced incentives, including a 30% step-up and reduced rehabilitation thresholds for existing buildings.

A Strategic Location With Opportunity Zones to Support Growth

While Opportunity Zones provide a valuable incentive, they work best in regions that already offer strong fundamentals. For communities like Palestine, the real advantage comes from pairing these designations with a strategic location and growing statewide interest from companies looking to expand in Texas.

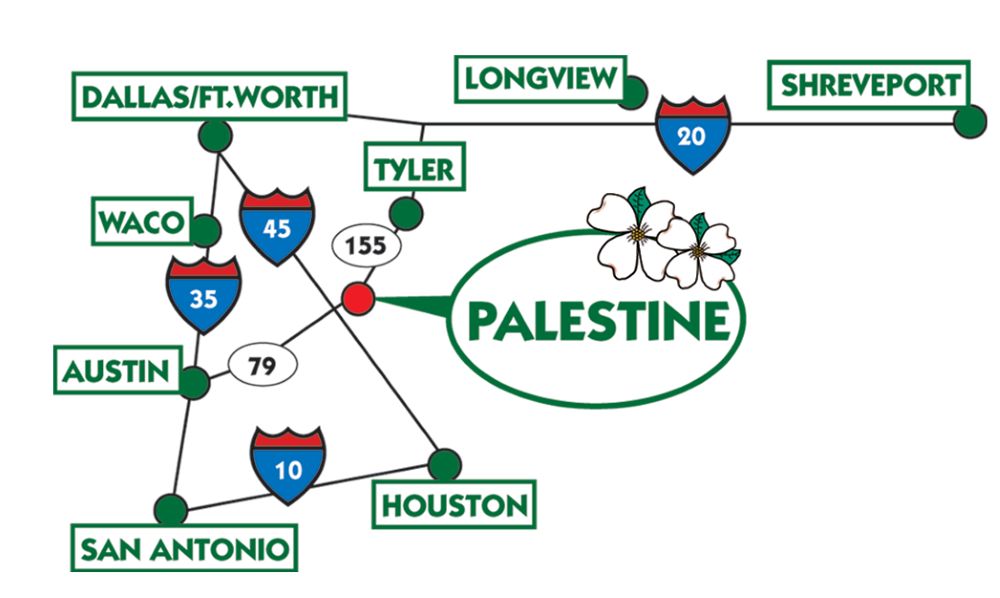

Palestine sits in the heart of East Texas, positioned within a few hours of Dallas–Fort Worth, Houston, Austin, and Shreveport. This centrality, combined with direct access to major highways and rail corridors, gives businesses the flexibility to reach key markets across the South and beyond. As interest in Texas continues to rise, more companies are evaluating regions like East Texas for their long-term logistics, cost-of-living, and workforce advantages.

That geographic advantage helps drive momentum when it aligns with business needs. Organizations like the Palestine Economic Development Corporation (PEDC) play a central role in positioning community assets—such as available sites and buildings, workforce partnerships, infrastructure access, and quality-of-life advantages—to attract expanding companies. PEDC also works to connect prospective investors with appropriate state and local incentive programs, including Opportunity Zones, that can enhance project feasibility. While Opportunity Zones can help close a deal, it is the strength of the project fit that most often drives site selector engagement.

“There has been a lot of excitement in Palestine in recent years because more companies are discovering the region,” says Christophe Trahan, Economic Development Director for PEDC. “We have unparalleled rail and highway access, with proximity to Mexico. It also helps that Texas is equidistant to the East and West coasts.”

Dr. Cecilia Cuellar Tapia also highlights the broader regional advantages of East Texas.

“This area has a rare combination of a good workforce, low cost of living, and a large amount of land,” she says.

These combined factors have helped attract recent international investment from companies such as LS Tractor and Callizo Aromas, reflecting growing confidence in the region’s location and operating fundamentals. While these projects were not driven by Opportunity Zone incentives, they underscore the type of investment environment where tools like Opportunity Zones can further enhance competitiveness.

Looking Ahead — Opportunity Zone 2.0

With the Opportunity Zone program now permanently authorized, communities such as Palestine have expanded long-term opportunities to benefit from private-sector investment. Beginning in 2027, Opportunity Zones will be reevaluated every ten years under stricter eligibility standards.

While these changes may reduce the number of eligible tracts statewide, they may also strengthen incentives for qualifying rural and regional communities. For Palestine and East Texas, this increases the importance of shovel-ready sites, infrastructure, and workforce development to remain competitive regardless of federal designation.

See What Attracts Investors to Palestine

Under Opportunity Zone 2.0, the designation itself may become more selective, but the financial benefits for qualifying projects — particularly in rural areas — may become stronger. This creates a dual opportunity for communities like Palestine to both protect existing designations and leverage enhanced incentives to attract housing, healthcare, redevelopment, and small-business investments that directly improve quality of life.

Palestine is in a growth phase, with new companies choosing to locate in this region and new families moving here each year. See what makes Palestine competitive beyond its Opportunity Zones. Get to know the community and explore available properties for your business expansion. Your workforce, your land, and your financial incentives can all be found here.

Contact PEDC today to learn more about Opportunity Zones and other tax incentives.

More Topics

.png)